MITSUBISHI, MITSU BACK $6 BILLION SEMPRA GAS TERMINAL - bloomberg.com

By Jim Polson - Apr 17, 2012 7:29 AM CT

Mitsubishi (8306) Corp. and Mitsui & Co. agreed to help Sempra Energy (SRE) develop a $6 billion natural-gas export facility in Louisiana, as Japan imported record amounts of the fuel.

Mitsubishi and Mitsui, both based in Tokyo, would each get a third of the 1.7 billion cubic feet a day of export capacity in exchange for helping develop the project, San Diego-based Sempra said today in a statement. The gas liquefaction plant will be part of Sempra’s existing import terminal in Hackberry, Louisiana.

A surge in U.S. shale-gas production has led owners of liquefied natural gas import terminals to propose exports as gas futures in New York tumbled to a 10-year low. Demand in Asia has climbed as Japan’s 10 regional electric utilities bought record amounts of LNG last year to generate power, replacing the output of nuclear plants. All but one of the nation’s 54 power reactors has been shut after the March 11, 2011, nuclear disaster at Fukushima.

The Louisiana facility may begin exporting gas in late 2016, pending regulatory approval and debt financing, Sempra said.

Construction of a $10 billion LNG export project by Cheniere Energy Inc. (LNG) was approved yesterday by the U.S. Federal Energy Regulatory Commission, clearing the way for the company to pursue debt financing.

To contact the reporter on this story: Jim Polson in New York at jpolson@bloomberg.net

To contact the editor responsible for this story: Susan Warren at susanwarren@bloomberg.net

Tags:

Replies to This Discussion

-

Permalink Reply by Eric Covington on April 17, 2012 at 2:55

Permalink Reply by Eric Covington on April 17, 2012 at 2:55 -

You beat me to it Skip ;)

Would you agree the authors, like dbob mentioned in the Cheniere article, got their export volumes wrong...2.2bcfg/year at the Cheniere Terminal article compared to 1.7bcfg/day for the Sempra Terminal

-

Permalink Reply by Skip Peel - Mineral Consultant on April 17, 2012 at 3:03

Permalink Reply by Skip Peel - Mineral Consultant on April 17, 2012 at 3:03 -

I haven't looked at the discrepancies in volumes, Eric. I'm more interested in the Big Picture as it relates to regulatory and financial hurdles at this point. Also the number of LNG facilities that can surmount those hurdles and the timeline to actual export operations.

-

Permalink Reply by P.G. on April 17, 2012 at 2:55

Permalink Reply by P.G. on April 17, 2012 at 2:55 -

Would mineral owners be paid US market prices or world market prices if the gas was exported?

-

Permalink Reply by dbob on April 17, 2012 at 3:31

Permalink Reply by dbob on April 17, 2012 at 3:31 -

Mineral owners are likely to be paid market prices - however, these faciliteis will likely hedge to one degree or another to make sure they are profitable. Also of note is that Cheniere has 16.9 bcf of storage capacity already at its site. I don't mean to get hung up on volumes, but agree with Skip, take the long view - which ones get passed the finacial and regualtory hurdles to actually get built. I don't think the first few LNG trains coming online will impact gas prices much, but may serve to act as a little bit of support.

-

Permalink Reply by Parkdota on April 17, 2012 at 5:21

-

Skip et al, I'm no pro but it seems that once there is a "bust", which I guess we kind of have now with supressed pricing on natgas and lowered rig counts, then moving forward there isn't much activity. However, this export situation seems to be a movement that can actually re-energize our natgas market(s) in the HA et al of both LA and TX. Would it be unrealistic to think that in 2015 and going forward we will see a pre-bust level of activity????

-

Permalink Reply by Skip Peel - Mineral Consultant on April 17, 2012 at 7:31

Permalink Reply by Skip Peel - Mineral Consultant on April 17, 2012 at 7:31 -

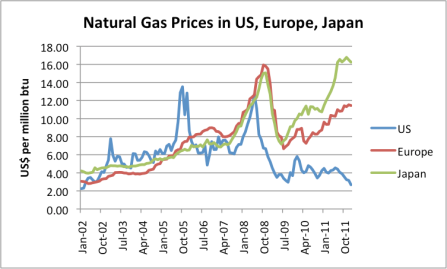

I think that LNG export will help stabilize the price of domestic natural gas. Energy companies do not require $10 per mcf to be profitable at the well head, $5 will do it. And at that price natural gas would be a bargain for all end users. As more LNG is exported, not just U.S. LNG, the price in overseas markets will come down. Although liquifying natural gas allows it to become a global commodity, cost to produce and export will still play a part in which producing countries can sell at what price in a specific market. U.S. LNG shipped from the West Coast would likely compete well in Japan for example. But Europe, especially southern Europe, might find cheaper LNG available from the middle east.

-

Permalink Reply by w.r. frank on April 17, 2012 at 14:33

Permalink Reply by w.r. frank on April 17, 2012 at 14:33 -

You will continue to get the blue line (whatever it is). We have excess NG production for domestic US consumption.

Hopefully, LNG export in 2016 will absorb some of the current overcapacity, coupled with less drilling and decline of existing wells, we might get some improvement. NG is a domestic commodity, not an international commodity like oil (even bottlenecks at Cushing create spread between WTI and Brent crude).

Sorry, you can't designate your little 1,000 mcf to go to Japan at $16/mmbtu while somebody else's 1,000 mcf goes to Henry Hub for $2/mmbtu. NG will continue to be priced off go HH and regional indexes.

-

Permalink Reply by P.G. on April 19, 2012 at 1:21

Permalink Reply by P.G. on April 19, 2012 at 1:21 -

Seems like an exporter would be all over this...

A lessor with a 25% royalty would be getting 50 cents for his ng from the exporter if the exporter owned the leases... the exporter could then compress that 50 cent gas and haul it to the world market for quite a markup...

Support GoHaynesvilleShale.com

Top Content

Not a member? Get our email.

Groups

-

San Augustine, TX

386 members

-

Rusk County

97 members

-

Vernon Parish

59 members

-

Natchitoches Parish

399 members

-

Bienville Parish, LA

242 members

-

Sabine County, Texas

172 members

-

Sabine Parish, LA

455 members

-

Cass County, TX

118 members

-

Angelina County, TX

87 members

-

Titus County

10 members

© 2024 Created by Keith Mauck (Site Publisher).

Powered by

![]()

| h2 | h2 | h2 |

|---|---|---|

AboutAs exciting as this is, we know that we have a responsibility to do this thing correctly. After all, we want the farm to remain a place where the family can gather for another 80 years and beyond. This site was born out of these desires. Before we started this site, googling "shale' brought up little information. Certainly nothing that was useful as we negotiated a lease. Read More |

Links |

Copyright © 2017 GoHaynesvilleShale.com